carried interest tax proposal

This distance calculator is designed for organisations taking part in the Erasmus Programme to calculate travel distances for grant. Earnings of the respondent are liable to be considered as the value for the purpose of levy and liability of service tax.

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

News Sports Betting Business Opinion Politics Entertainment Life Food Health Real Estate Obituaries Jobs.

. In 1981 the Section 121 exclusion was increased from 100000 to 125000. A deal brokered by Senate Majority Leader Chuck Schumer D-NY and Sen. Get to know the tax benefits on home loan interest for the FY.

The British Broadcasting Corporation BBC is the national broadcaster of the United KingdomHeadquartered at Broadcasting House in London it is the worlds oldest national broadcaster and the largest broadcaster in the world by number of employees employing over 22000 staff in total of whom approximately 19000 are in public-sector broadcasting. This tool is not designed for individuals to determine how much they should receive in funding. Remaining interest will be carried forward to the next assessment year.

Iii The interest restructuring. 2 Totals may not add due to rounding. The outdated inheritance tax rules costing families 137330.

These amounts are dependent on various factors including administrative costs incurred by participating organisations and the National Agencies. As mortgage interest remained deductible. Martin Lewis warns lending rules need to change to avert a mortgage crisis.

Keep reading by creating a free account or signing in. 1 A indicates a nil amount a small amount less than 500000 or an amount that cannot be determined in respect of a measure that is intended to protect the tax base. Since these fees are generally not taxed as normal income some believe that the structure unfairly takes advantage.

For the performance of a task carried out in the public interest or in the exercise of official authority vested in the controller Member States should be allowed to maintain or introduce national provisions to further specify the application of the rules of this Regulation. Having regard to the proposal from the European Commission. Also we have included tax benefits on principal repaid interest Paid etc.

The Tax Reform Act of 1986 eliminated the tax deduction for interest paid on credit cards. Government policies Housing tax policy. Latest breaking news including politics crime and celebrity.

Papers from more than 30 days ago are available all the way back to 1881. Please note that if the home loan interest is for self-occupied property then only Rs. The best opinions comments and analysis from The Telegraph.

There is a fee for seeing pages and other features. Carried interest or carry in finance is a share of the profits of an investment paid to the investment manager specifically in alternative investments private equity and hedge fundsIt is a performance fee rewarding the manager for enhancing performance. Check out the latest breaking news videos and viral videos covering showbiz sport fashion technology and more from the Daily Mail and Mail on Sunday.

Find stories updates and expert opinion. 3 An important proportion of the overall projected revenue impact 75 relates to the expectation that the measure will help in. In economic science the tragedy of the commons is a situation in which individual users who have open access to a resource unhampered by shared social structures or formal rules that govern access and use act independently according to their own self-interest and contrary to the common good of all users cause depletion of the resource through their uncoordinated action.

In July 1978 Section 121 allowed for a 100000 one-time exclusion in capital gains for sellers 55 years or older at the time of sale. Get the latest international news and world events from Asia Europe the Middle East and more. The respondent believed that the activities carried on by it was not taxable and the belief of the respondent stands justified by the order of the Commissioner dropping the charges.

However the proposal was removed. Va initially proposed curtailing the tax break for carried interest.

What Would The New Carried Interest Loophole Proposal Do The New York Times

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

/cloudfront-us-east-2.images.arcpublishing.com/reuters/22RXIEMDFFN67MGAUYELV7HTYY.jpg)

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

Carried Interest Loophole For Real Estate Saved Again

More Chips For Tax Reform The New York Times

Carried Interest Lives On Despite Tax Reform Pensions Investments

The Carried Interest Debate Is Mostly Overblown Tax Foundation

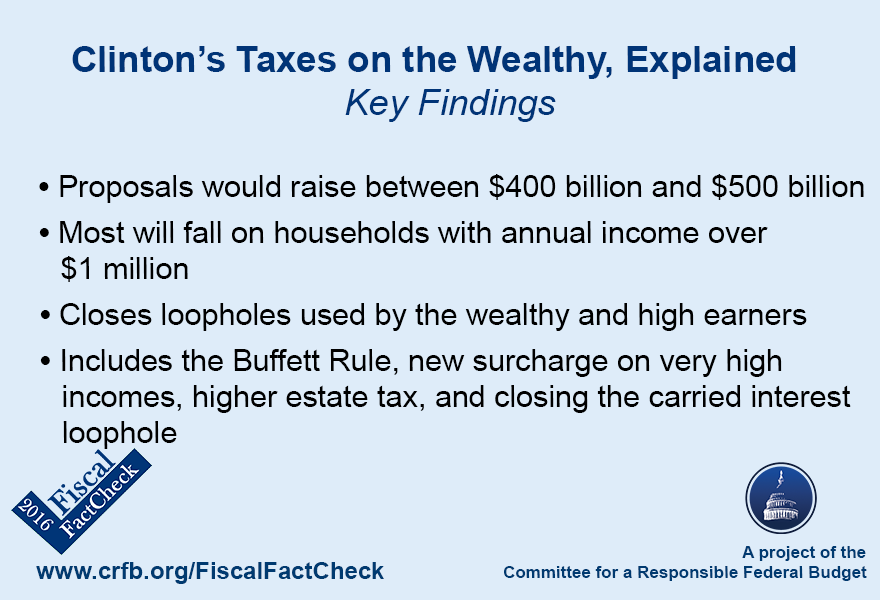

Clinton S Taxes On The Wealthy Explained Committee For A Responsible Federal Budget

Gop Must Ignore Pleas To Raise Taxes On Carried Interest Capital Gains

Carried Interest Tax Loophole Part Of Manchin Inflation Bill

What The Proposed Tax Plan Means For Commercial Real Estate Voit Real Estate Services

Biden Administration Tax Proposals Implications For Commercial Real Estate United States Cushman Wakefield

Hedge Pe Funds Object To Carried Interest Tax Hike Proposal Newsmax Com

Carried Interest Tax To Carry Water For Reform

How Private Equity Won Its Battle Over Carried Interest Barron S

Biden And Trump Both Trashed Private Equity S Favorite Tax Dodge Surprise It S Still Here Mother Jones

Sinema Made Schumer Cut Carried Interest Piece Of Reconciliation Bill